Hello traders! Today I want to write about order lot calculation.

Before placing an order a trader must to set lot size of the position.

How calculate the lot size?

It's depends on your trading strategy, trading plan, term, currency pairs and deposit size.

Existing many ways for setting up a lot size let's check most common:

- Using fixed lot size. Nothing to add here, you just using static lot comfortable for you. Let say 0.25 lot is nice volume for trading without stress or any other. This lot method using for pyramiding or grid trading with accumulation of volumes by trend directions.

- Lot based on probability of an entry setup. So if you belive what trading setup have high chance to hit take profit target you can increase lot size. Double of your usual size or any other way or decreasing for weak setups(many traders prefer don't trade weak trades).

- Increasing lot size after loosing trades for covering drawdown of your trading account or increasing in profits. Martingale, Anti-martingale, Parlay and other progression methods. This is from gambling world but many using it with forex trading and binary options.

- Books, trading communities, mentors or professional traders usual telling you to use lot calculation based on percentage of your deposit. And this is smart because hole idea to do not risk your entire money is nice, this is part of money management you must to learn it. The percentage value each trader tweaking for themself but many traders using 1-3% from trading account. But common mistake is using plain lot size calculated by persentage from account for every trading situation.

I want you to understand this clear – If you open two orders with different stop loss the lot size for the trades should be different.

And this is called risk management. This method based on risk percent you'll put in your stop loss so if the price will hit your stop loss you loose only 1% of your money.

How to calculate the lot size for your account and stop loss level?

For pairs with second USD (xxxusd) formula looks like this:

Money = (Deposit / 100) x Risk%

Lot = Money / Stop Loss

For example:

Deposit = $1000

Risk = 2%

Stop Loss = 10pips or 100 points

($1000 / 100) x 2% = $20 (this money you can risk for an order)

$20 / 100points = 0.2 Lot

If you trade a pair without second usd in a symbol you need to make additional steps

Open site of your broker and find pip value for your trading pair in traders calculator and calculate coefficient by formula

Coefficient = 1 / pip value

and your calculated previous Lot multiply by the Coefficient

Money = (Deposit / 100) x Risk%

Lot = Money / Stop Loss

Coefficient = 1 / pip value

Lot x Coefficient

For example:

you trade AUDCAD for this pair 1 pip today equal $0.74

Deposit = $1000

Risk = 2%

Stop Loss = 10pips or 100 points

($1000 / 100) x 2% = $20 (this money you can risk for an order)

$20 / 100points = 0.2 Lot

1 / $0.74 = 1.351351351351351

0.2 x 1.351351351351351 = 0.2702702702702702 or 0.27

0.27 this is your Lot size

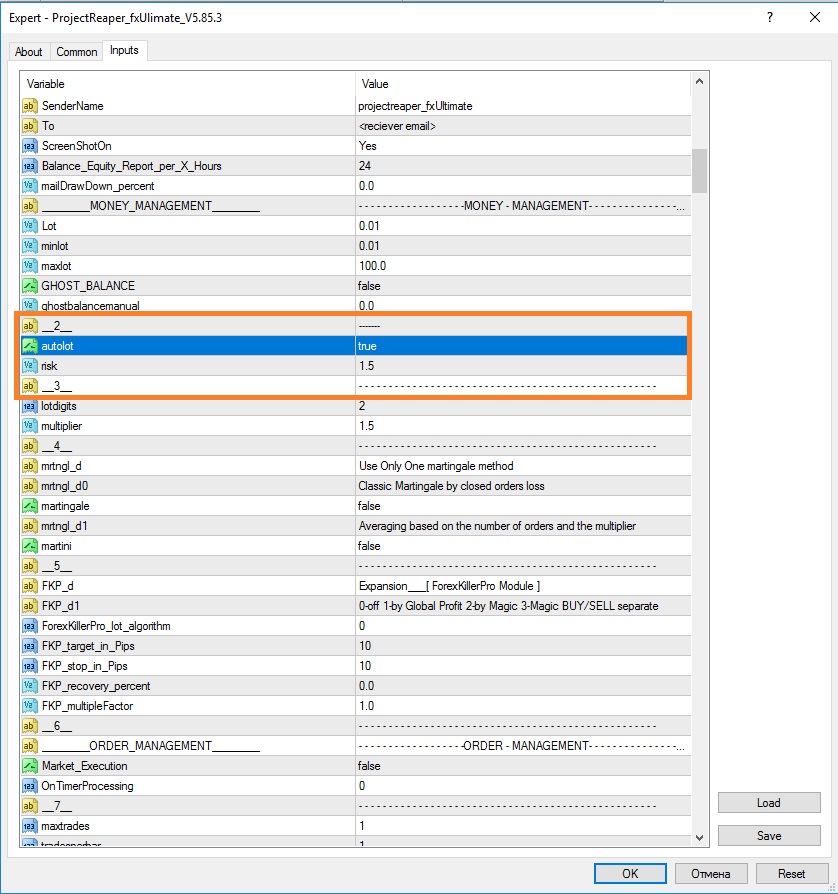

Projectreaper fxUltimate version have autolot parameter for automatic calculation lot size by this formula.

You can find this parameter in expert advisor settings list Money management section:

You need just set autolot to true and enter risk value.

If you do not set any stop loss the algirithm will calculate your lot size by a simple formula based only on your account.

Proper risk management calculation is very important for manual trading and full auto algorithmic trading. It helps you to save your account from big drawdown.

If you need help

Write down comment or use the feedback button

Very helpful!

Can I try your soft in trial?

Thanks mate!

By the >>link<< you can find free version. Free or trading in any accounts without any limitations.